At Savings Bank of Walpole we are always looking for ways to improve on your customer experience. If you can’t find your answer here, please complete the form in the Contact Us page and let us know how we can help you!

How can we help you?

Debit Mastercard® Questions

How do I activate my Debit Card?

To activate your SBW debit card, call 1-844-202-0844 and follow series of prompts.

How do I change my Debit Card PIN Number?

If you know your Debit Card PIN number and would like to change it, you can do so at any SBW ATM. If you need to reset your pin without knowing your existing pin, use Tellerphone by calling 1-844-202-0844. You can also use the 1-800-290-7893 or 1-206-624-7998 (for international cardholders).

How do I get a replacement card?

To order a new debit card, give us a call or stop by any of our convenient locations.

How do I report A Lost or Stolen Debit Card?

To report a lost or stolen debit card:

- To report your card lost or stolen during business hours, call us at (603) 352-1822 or (877) 925-7653.

- After business hours, call TellerPhone at (603) 355-1696, the main line at (877) 925-7653, or call the Card Center directly at (888) 297-3416.

You should report a lost or stolen debit card as soon as possible to prevent fraudulent transactions from being processed against your account. When we hear from you we will immediately disable your current card number.

Lost or Damaged SBW Debit Card?

Come in and replace it instantly at one of our branch locations. A replacement card can also be mailed to your address on file.

What is the Bank’s Routing Number?

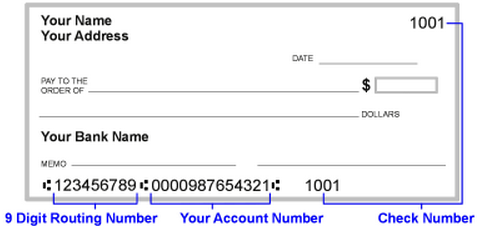

The Savings Bank of Walpole routing number is 211770093. The routing number, also referred to as the ABA number, is used for direct deposits, direct payments, and wire transfers.

Where to find your account number and bank’s routing number:

How do I Close An Account at SBW?

Here are multiple ways to submit a request to close your account.

Give us a call!

You can call your local branch or customer support at (603) 352-1822.

Send us a fax:

(603) 355-1630

Send us a letter:

Savings Bank of Walpole

Attn: Deposit Operations

PO Box 744

Keene, NH 03431

Send a secure message:

Login to Online Banking, go to Messages, and send us your request.

For a checking account, you can also write a check for the amount remaining in the account and write on the memo line “To close account”.

Both the letter and faxed request require an authorized signer’s signature to process your request. If you have questions, please contact customer support at (603) 352-1822.

Tax Information

When Will I Receive My 1099 Tax Forms?

If your total interest paid on deposit accounts was less than $10, you will not receive a 1099INT. The year-to-date (YTD) interest paid for each account is also reported on your monthly bank statement. This information is also available when viewing your account online. For more information, please contact us at (603) 352-1822.